In the small Vancouver Island community of Sayward, British Columbia, a new grassroots movement—the Sayward Taxpayers Alliance—has become a prominent voice calling for fiscal restraint, government reform, and a fresh look at how local services are delivered. Formed by concerned residents, the Alliance reflects growing unease about rising municipal costs, increasing tax burdens, and the long‑term sustainability of Sayward’s current governance structure.

Origins and Purpose

The Sayward Taxpayers Alliance describes itself as “a grassroots alliance of citizens who are opposed to wasteful spending of taxpayer dollars.” Its mission is to push for stronger financial accountability at the municipal level and to ensure residents have a meaningful say in decisions that shape their taxes and community services.

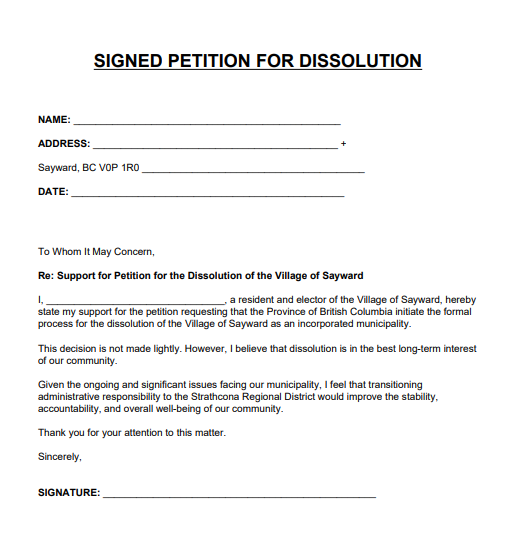

A Bold Proposal: Dissolving the Village

Central to the Alliance’s platform is a significant and controversial idea: dissolving the Village of Sayward as an incorporated municipality and integrating it fully into the Strathcona Regional District (SRD). Supporters argue that this shift would streamline governance, reduce administrative overhead, and potentially deliver services more efficiently—ultimately easing the tax burden on property owners.

They contend that a small municipality like Sayward struggles to maintain a standalone council and administrative staff without duplicating services already available through the SRD. Dissolution, they say, is a practical response to the financial and operational pressures facing rural local governments across British Columbia.

Why Dissolution?

According to the Alliance, several potential benefits support the case for change:

- Reduced Administrative Load: Sayward would no longer need its own council and municipal bureaucracy; instead, residents would be represented by an SRD director.

- Stronger Governance Capacity: Regional administration, they argue, can offer more professional oversight and long‑term planning than a small, resource‑limited local council.

- Possible Tax Relief: While not guaranteed, integrating services regionally could help stabilize or even lower property taxes over time.

These arguments echo concerns that have surfaced repeatedly in local news, including council dysfunction, resignations, and questions about financial planning and service delivery. For some residents, these issues signal that the village’s current governance model may no longer be viable.

Building Community Momentum

To advance the dissolution effort, the Alliance is organizing petition drives aimed at triggering a provincially guided governance review. Only eligible voters living within the Village of Sayward and aged 18 or older can sign. If the petition meets the required threshold, the process could lead to a formal review or even a community vote under the Local Government Act.

Beyond Governance: Life in Sayward

The Alliance’s work unfolds against the backdrop of a small rural community navigating broader challenges—from infrastructure needs to the cost of recreational services. Sayward relies on a mix of local, regional, and provincial supports, and debates about governance are intertwined with questions about long‑term sustainability and quality of life.

Looking Forward

As the Sayward Taxpayers Alliance continues its campaign, it has become a catalyst for deeper conversations about local democracy, financial stewardship, and the future of small municipalities in British Columbia. Whether dissolution ultimately moves forward remains uncertain, but the movement has already sparked a significant community dialogue about how to balance effective governance with affordability and local values.

Petition Form

Click on the petition to download a printable copy.