For most homeowners in Sayward, paying property taxes is a routine annual responsibility. But when finances tighten, falling behind can quickly become overwhelming. Knowing how the process works in British Columbia—and how it applies specifically in the Village of Sayward—helps residents make informed choices before the situation becomes serious.

Property Taxes Are a Legal Obligation

In British Columbia, municipal property taxes are mandatory. They are secured against the property itself rather than the individual owner. As a result, unpaid taxes stay with the land, regardless of who owns it or whether the property is refinanced.

If taxes are not paid by the annual deadline (usually July 2), penalties are applied immediately. In Sayward, as in most BC municipalities, a 10% penalty is added to any outstanding balance—even if only a small amount is overdue.

Year One: Arrears and Penalties

During the first year of non-payment, taxes move into arrears. Interest may also accumulate depending on local policy. The homeowner still retains full ownership, but the debt continues to grow.

Partial payments are typically allowed and can reduce interest charges, though they do not reverse penalties already applied.

Year Two and Beyond: The Property Tax Sale

If taxes remain unpaid for three consecutive years, the property becomes eligible for a tax sale. In BC, tax sales take place annually on the last Monday of September.

At a tax sale:

-

The municipality auctions the property to recover unpaid taxes, interest, and associated costs.

-

The opening bid equals the amount owed—not the property’s market value.

-

Properties may sell for significantly less than their assessed worth.

Importantly, ownership does not transfer immediately at the sale.

The One-Year Redemption Period

After the tax sale, the original owner enters a one-year redemption period. During this time, the homeowner can reclaim the property by paying:

-

All outstanding taxes

-

Interest

-

Penalties

-

Legal and administrative fees

If the full amount is paid within the year, the sale is cancelled and ownership remains with the homeowner.

If the Property Is Not Redeemed

If the homeowner does not redeem the property within the one-year period:

-

Ownership is legally transferred to the tax sale purchaser.

-

The former owner permanently loses the property.

-

No compensation is provided for any remaining equity.

This means a home worth hundreds of thousands of dollars can be lost over a relatively small tax debt.

Can the Municipality Take Your Home Directly?

BC municipalities cannot simply seize a property for unpaid taxes. They must follow the tax sale process. However, the end result—loss of the home—can still occur if taxes remain unpaid long enough.

Options for Homeowners Facing Difficulty

Homeowners who are struggling should act early. Possible steps include:

-

Contacting the Village for clarification or to discuss payment timing

-

Exploring refinancing or short-term borrowing

-

Applying for the BC Property Tax Deferment Program (available to qualifying seniors, families with children, and persons with disabilities)

Delaying action significantly reduces available options.

A Serious but Preventable Outcome

BC’s property tax enforcement system is strict but predictable. Losing a home over unpaid taxes is uncommon, yet it does happen—often because homeowners misunderstand the process or wait too long to seek help.

For Sayward residents experiencing financial hardship, early communication and a clear understanding of the system can be the difference between a temporary setback and a permanent loss.

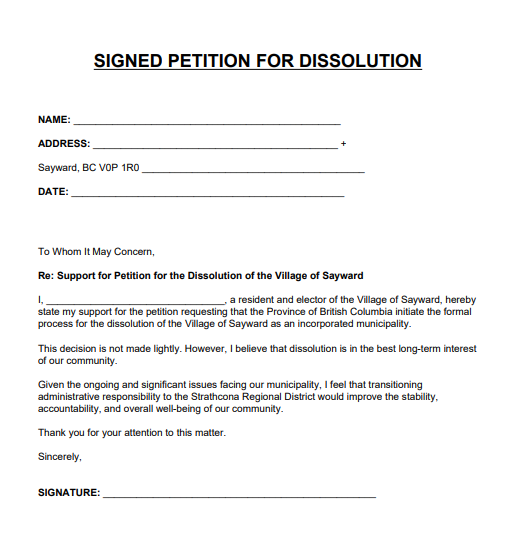

Signing the petition means your voice is heard in calling for: reduced administrative burden, governance improvements, respect of citizen concerns, fiscal responsibility and professionalism.