Plankton Are Small Aquatic Drifters With A Big Impact

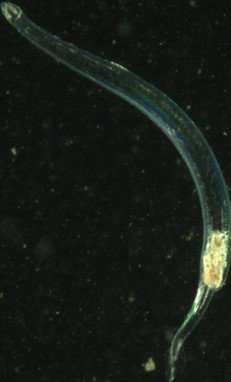

Plankton are an incredibly diverse group of organisms that inhabit oceans, lakes, and rivers. They range from microscopic bacteria and algae to small animals like crustaceans and gelatinous creatures. What unites them is their limited ability to swim against currents, leaving them to drift wherever the water carries them. Some species remain plankton for their entire lives, while others — including many fish and shellfish — are plankton only during their earliest developmental stages.

Despite their minuscule size, plankton are fundamental to life in the Pacific Ocean and the health of aquatic ecosystems.

Keeping Earth Habitable

Phytoplankton, the plant-like members of the plankton community, use sunlight to convert carbon dioxide and water into organic matter and oxygen through photosynthesis. Remarkably, they generate roughly half of the oxygen in Earth’s atmosphere.

They also play a major role in climate regulation. Through the biological pump, phytoplankton help transfer carbon from the atmosphere into the deep ocean, reducing atmospheric carbon dioxide and helping stabilize global temperatures over long timescales.

The Base of Aquatic Food Webs

Plankton sit at the foundation of nearly every aquatic food web. Phytoplankton produce the organic material that nourishes zooplankton, which in turn feed fish, seabirds, and marine mammals.

Countless species — from small fish and shellfish to the largest whales — depend directly or indirectly on plankton for survival. Plankton also support water quality by filtering particles and breaking down organic matter.

Economic Value

Because they underpin aquatic food webs, plankton are vital to pacific fisheries and the coastal communities that depend on them. Some species, such as krill and certain jellyfish, are harvested directly for food, aquaculture, and nutritional supplements.

Over geological time, plankton have even contributed to modern energy resources. The remains of ancient plankton that settled on the seafloor millions of years ago helped form today’s oil and natural gas deposits.

Cultural and Social Importance

Healthy plankton populations enhance recreation, tourism, and cultural experiences. Plankton blooms can influence activities like swimming and boating, while bioluminescent plankton create glowing waters that captivate visitors. Their intricate shapes and patterns have also inspired art, design, and scientific illustration across cultures.

Why Plankton Matter

Often overlooked, plankton are essential to life. They generate oxygen, regulate climate, support marine food webs, sustain economies, and enrich human culture. Protecting aquatic environments means safeguarding plankton — and the countless systems that rely on them.